While FX forwards have long served as a valuable tool for creating certainty, today's dynamic business environment demands a higher degree of flexibility. In a market where currency values can shift based on local and international pressures, being locked into a fixed rate can mean missing out on significant favorable moves. A rigid forward contract can become a liability in these situations. It's time to look at FX options not as a replacement for forwards but an additional tool in a corporate treasury department’s toolkit.

What is the Standard: The Rigidity of FX Forwards

An FX forward contract is a simple and effective tool for achieving absolute certainty, and its importance cannot be overstated. By locking in an exchange rate for a future date, a corporate treasurer can eliminate the currency risk on a confirmed transaction, guaranteeing a specific JMD cost or revenue figure. However, its primary strength is also its greatest weakness: it is an unbreakable obligation. A business is legally bound to transact at the agreed-upon rate, regardless of whether the market moves in its favor or if the underlying business deal changes. This creates the linear payoff diagrams we are all so familiar with.

Figure 1: A linear payoff diagram for a long FX forward contract.

FX Options Explained

This is where FX options introduce a new level of sophistication. An FX option is a contract that gives the owner the right, but not the obligation, to exchange two currencies at a pre-agreed rate on (European options) or before (American options) a future date. The best way to understand this is through an insurance analogy. When you buy an option, you pay a small, upfront fee known as the premium in exchange for protection. If the market moves against you, your "insurance" kicks in, and you can exercise your right to transact at the favorable, pre-agreed rate. If the market moves in your favor, you can simply let the option expire worthless and transact at the better prevailing market rate, having only lost the initial premium.

This flexibility is built on a few core components. A call option grants the right to buy a foreign currency, which is ideal for an importer looking to protect against a strengthening USD. Conversely, a put option grants the right to sell a foreign currency, perfectly suited for an exporter wanting to protect against a weakening USD. The pre-agreed exchange rate in the contract is called the strike price, and the cost of securing this flexibility is the upfront, non-refundable premium.

Understanding the Cost: What Drives the Option Premium?

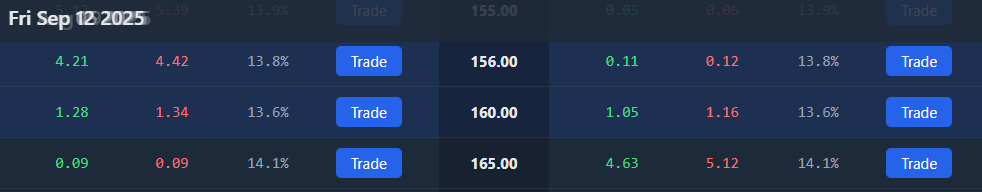

While forward prices are determined solely by interest rate differentials and the tenor, the price of an option is influenced by two additional factors; volatility, and the chosen strike price. Market volatility is critical as more volatile currency pairs have a greater probability of large price swings, which increases the value of the protection an option provides and, therefore, its cost. The strike price itself matters. An option with a strike price very close to the current market rate is more likely to be exercised and will be more expensive than one with a strike price further away.

Figure 2: USDJMD Options prices taken from Celeraq trading simulator on September 5, 2025 with an expiry date of september 12, 2025

Fine-Tuning Risk for Jamaican Businesses

Let's look at two scenarios where real-world business scenarios where volatility is a key factor. Imagine a Kingston-based construction company bidding on a major infrastructure project that requires importing USD $500,000 worth of specialized equipment. The tender results won't be announced for another 60 days. The treasurer faces a dilemma: using a forward contract is too risky because if they lose the bid, they are still obligated to buy half a million US dollars they no longer need. However, doing nothing leaves the project's budget exposed to a potential depreciation of the JMD. The option solution is to buy a USD call option. If they win the bid and the JMD weakens, their maximum equipment cost in local currency is capped by the option's strike price. If they lose the bid, they simply let the option expire, and their only loss is the premium paid, a smaller, more manageable cost of doing business.

Consider another scenario involving a coffee exporter that has a contract with a US buyer, but the final volume of the shipment depends on the success of the upcoming harvest, with expected revenue between USD $200,000 and $300,000. Hedging the full $300,000 with a forward is speculative, while hedging the minimum of $200,000 leaves a significant portion of their revenue exposed to currency risk. By using a USD put option, the exporter can set a "worst-case" exchange rate for their sales. This establishes a minimum JMD revenue floor, guaranteeing profitability while allowing them to fully benefit from a favorable market move if the JMD weakens, which would make their USD revenues worth more.

Conclusion: A New Era of Strategic Hedging

Ultimately, FX options allow businesses to graduate from simple "all-or-nothing" hedging to a more nuanced and strategic approach to risk. They empower a treasurer to fine-tune their risk management strategy by separating downside protection from upside opportunity. For Jamaican companies interacting with international markets, mastering these instruments is a critical step toward building financial resilience. As Jamaica's financial landscape matures, access to and education on sophisticated tools like options are essential.

Celeraq is committed to this vision, developing pricing models to accurately estimate volatility measures necessary for robust pricing of these securities. Interested parties can interact with these pricing models through our free derivatives trading simulator here.